Introduction

Customer Success Platforms (CSP) are centralized operating systems that aggregate customer data from various sources—CRM, product usage, support tickets, and financial systems—to provide a holistic view of account health. These platforms have transitioned from reactive reporting tools into “Agentic Success Hubs.” They now employ autonomous AI agents that don’t just alert a Customer Success Manager (CSM) to a risk, but actively suggest or even execute the necessary intervention.

The relevance of CSPs is driven by the mandate for “Efficient Growth.” With the cost of capital remaining significant and the expense of acquiring new customers far exceeding retention costs, organizations are prioritizing Net Revenue Retention (NRR). Modern CSPs allow teams to manage 50% more accounts per CSM by automating administrative tasks like drafting QBRs (Quarterly Business Reviews), updating CRM fields, and monitoring for “silent churn” signals.

Real-world use cases include:

- Churn Mitigation: Automatically flagging accounts with declining login frequency or key stakeholder departures.

- Expansion Intelligence: Identifying high-usage power users who are prime candidates for upsell or cross-sell opportunities.

- Automated Onboarding: Delivering personalized, in-app milestones that adapt based on a user’s specific role and behavior.

- Health Scoring: Combining sentiment analysis from email/calls with telemetry data to create a predictive 360-degree health score.

- Executive Reporting: Generating real-time dashboards for the Board of Directors that link CS activities directly to revenue outcomes.

What buyers should evaluate (Criteria):

- Time-to-Value: How quickly the platform can ingest data and provide actionable health scores (weeks vs. months).

- AI Agency: The ability of the AI to perform “work” (writing emails, updating records) rather than just providing “insights.”

- Data Integration Depth: Seamless bidirectional syncing with Salesforce, HubSpot, Snowflake, and Zendesk.

- Workflow Automation: The robustness of “Playbooks” that trigger based on specific customer behaviors or milestones.

- Scalability: Performance levels when tracking millions of product events across thousands of accounts.

- User Adoption: The intuitiveness of the interface for CSMs who spend 6+ hours a day in the tool.

Key Trends in Customer Success Platforms

The landscape is defined by a shift from human-led monitoring to AI-orchestrated outcomes.

- Agentic CS Operations: AI agents like “Retention Forecasters” and “Handoff Assistants” now handle the 70% of routine CS work that used to be manual.

- Sentiment Telemetry: Real-time analysis of call recordings and emails to detect frustration or delight, adjusting health scores instantly.

- Outcome-Led Onboarding: A move away from “feature training” toward “value realization,” where the platform tracks if the customer actually achieved their stated business goal.

- Digital-First Scaling: High-performing teams now use CSPs to deliver “Human-Lite” service to SMB segments without sacrificing the quality of the experience.

- Revenue Accountability: CS teams are being measured on CSQLs (Customer Success Qualified Leads) and expansion revenue, moving them closer to the sales org.

- Predictive Churn Models: Transitioning from “Basic Health” (Green/Yellow/Red) to probabilistic models that forecast the exact month a renewal is at risk.

- Customer-Facing Portals: Shared workspaces where clients can see their own progress, success plans, and shared documents in real-time.

- Regulatory Compliance Automation: Platforms now automatically redact PII (Personally Identifiable Information) from call transcripts to meet global privacy standards.

How We Selected These Tools (Methodology)

Our selection utilizes a multi-dimensional SaaS evaluation framework focused on professional post-sales environments:

- Market Viability: We included both established legacy leaders and “AI-Native” disruptors gaining significant market share.

- Integration Reliability: We prioritized tools with native, stable connectors that prevent the formation of “data silos.”

- Functional Depth: Each tool was assessed for its ability to handle complex lifecycle management, from kickoff to renewal.

- Innovation Velocity: Preference was given to vendors who have updated their core architecture to support agentic AI workflows.

- Enterprise Security: Verification of “Compliance-by-Design,” including SOC 2 Type II and GDPR readiness.

- Customer Sentiment: Analysis of peer reviews and G2 rankings to gauge real-world satisfaction and ease of use.

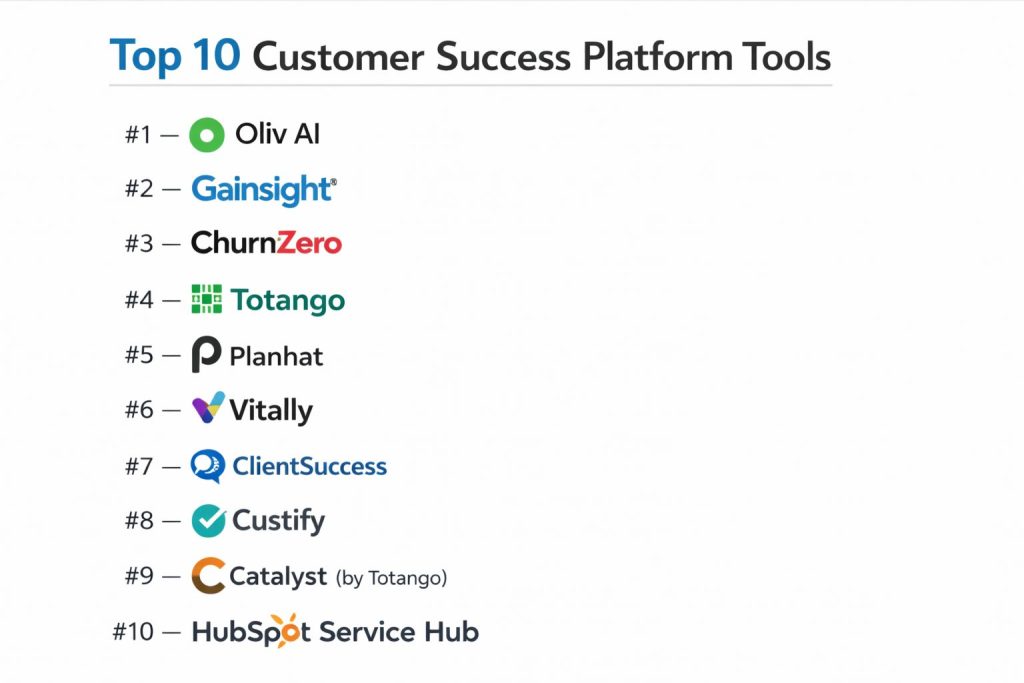

Top 10 Customer Success Platform Tools

#1 — Oliv AI

An AI-native revenue orchestration platform that uses autonomous agents to handle CRM hygiene, call summaries, and retention forecasting.

Key Features

- Retention Forecaster Agent: Autonomously analyzes account signals to predict renewal outcomes with high accuracy.

- Handoff Assistant: Smoothly transitions data from Sales to CS by summarizing all pre-sale context and requirements.

- CRM Manager Agent: Updates Salesforce/HubSpot fields automatically based on the context of customer conversations.

- QBR Builder: Generates 80% of a Quarterly Business Review deck by pulling usage data and verified outcomes.

- Sentiment Tracker: Real-time monitoring of customer “tone” across all digital and voice touchpoints.

- Modular Agent Pricing: Allows organizations to pay only for the specific AI agents they need.

Pros

- Low Manual Input: Drastically reduces the “admin tax” on CSMs, allowing them to focus on strategy.

- Speed to Value: Can be operational in days rather than months due to its AI-first architecture.

Cons

- Newer Entrant: Lacks the decades-long “thought leadership” community of legacy players like Gainsight.

- B2B Focus: Primarily optimized for high-contract-value B2B SaaS rather than high-volume B2C.

#2 — Gainsight

The industry standard for enterprise customer success. Gainsight is a massive, feature-rich platform designed for complex, global organizations.

Key Features

- Customer 360: A comprehensive dashboard that pulls every imaginable data point into a single account view.

- Journey Orchestrator: Advanced tool for building complex, automated customer lifecycles across segments.

- Gainsight Horizon AI: A suite of AI tools for sentiment analysis, survey summarization, and task prioritization.

- Success Plans: Collaborative digital documents for tracking shared goals between the vendor and the customer.

- Gainsight Product Experience (PX): Integrated product analytics to track user behavior directly within the CS tool.

- Sponsor Tracking: Monitors LinkedIn for key stakeholder job changes that could risk the account.

Pros

- Deepest Feature Set: There is virtually no CS workflow that Gainsight cannot handle.

- Community: The “Pulse” community provides unparalleled networking and best-practice sharing.

Cons

- Implementation Heavy: Often requires 3-6 months and a dedicated administrator to set up and maintain.

- High Cost: The “Essentials” plan starts high, and enterprise costs can be prohibitive for smaller teams.

#3 — ChurnZero

A high-performance CS platform focused on real-time visibility and ease of use for mid-market SaaS companies.

Key Features

- Real-Time Alerts: Triggers notifications for CSMs based on immediate product usage drops or spikes.

- Command Center: A centralized hub for CSMs to manage their daily tasks, alerts, and communications.

- In-App Communications: Allows CS teams to send targeted messages and walkthroughs directly to users inside the product.

- Walkthroughs & Guides: Integrated onboarding tools that help users reach their “Aha!” moment faster.

- Segmentation Engine: Highly granular filtering to target specific groups of customers for playbooks.

- Net Promoter Score (NPS): Native survey tools to track and report on customer sentiment and loyalty.

Pros

- User Experience: Consistently rated higher than Gainsight for ease of use and daily CSM adoption.

- Reporting: Very strong out-of-the-box reporting that doesn’t require technical expertise.

Cons

- Integration Rigidity: Some users report that custom integrations can be more difficult than with other platforms.

- Enterprise Depth: While strong for mid-market, it may lack some of the global governance features of Gainsight.

#4 — Totango

A modular, “SuccessBLOC” based platform that allows teams to start small and scale their CS operations over time.

Key Features

- SuccessBLOCs: Pre-built “modules” for specific goals like “Onboarding,” “Renewal,” or “Upsell.”

- Canvas: A visual workflow builder that maps the entire customer journey in a drag-and-drop interface.

- Zoe: A conversational interface that allows non-CS employees (Sales, Product) to access customer data.

- Health Scoring: Multi-dimensional scoring that can be customized for different customer tiers.

- Team Management: Tools for managing CSM workloads and account assignments across the organization.

- Enterprise Multi-tenancy: Supports large organizations with multiple products and business units.

Pros

- Modular Growth: You only use (and pay for) the parts of the platform you actually need today.

- Flexibility: Very easy to iterate on workflows as the business model evolves.

Cons

- Account Structure: Some users find the hierarchical account structure less flexible for complex parent/child relationships.

- Formatting: Documentation and formatting capabilities within the tool can feel limited compared to competitors.

#5 — Planhat

A modern, data-driven CS platform that excels at portfolio management and beautiful data visualization.

Key Features

- Data Lake Integration: Can ingest massive amounts of raw data from sources like Snowflake or BigQuery.

- Custom Dashboards: Highly flexible and visually appealing reporting for both CSMs and Executives.

- Customer Portal: A professional-grade, white-labeled portal for clients to track their own success.

- Usage Tracking: Deep integration with product telemetry to show exactly how features are being used.

- Revenue Management: Integrated tools for tracking subscriptions, renewals, and expansion revenue.

- Playbook Automation: Sophisticated logic for triggering internal and external actions based on data.

Pros

- Design & UX: Often cited as the most “beautiful” and modern interface in the CSP category.

- Performance: Handles large data sets with minimal lag, making it great for high-volume accounts.

Cons

- Setup Complexity: The platform’s flexibility means it can take significant effort to “build” the perfect environment.

- Support: Some users have reported slower response times during peak implementation periods.

#6 — Vitally

A productivity-focused CSP that blends project management with customer success data, ideal for agile teams.

Key Features

- Shared Docs: Collaborative documents that allow CSMs and customers to work together in one place.

- Custom Objects: Flexibility to track unique data points that don’t fit into standard “Account” or “Contact” fields.

- Productivity Hub: Combines email, tasks, and notes into a single view to eliminate tab-switching.

- Automated Playbooks: Powerful triggers based on account health or lifecycle stage.

- Health Score Equations: Allows for complex mathematical formulas to determine account health.

- Integrations: Strong native connections to tools like Segment, Slack, and Intercom.

Pros

- Team Collaboration: Best-in-class features for internal and external collaboration.

- Onboarding Speed: Much faster to deploy than legacy enterprise solutions.

Cons

- Feature Maturity: Some advanced features (like predictive AI) are newer and may feel less “baked” than competitors.

- Tiering: Some of the most valuable features are locked behind the higher-priced “Enterprise” tier.

#7 — ClientSuccess

A “relationship-first” platform designed specifically for the needs of growing CS teams that prioritize high-touch engagement.

Key Features

- SuccessScore: A proprietary health scoring model that balances subjective sentiment and objective data.

- SuccessCycle: A visual way to define and track the various stages of the customer lifecycle.

- Pulse: A quick, subjective “gut check” score that CSMs can update in seconds after a call.

- Executive Dashboards: Simple, clean views for leadership to track NRR and churn risk.

- Native Communication: Email integration that tracks all outreach and responses automatically.

- Template Library: Pre-built templates for success plans and playbooks.

Pros

- Intuitive UI: Very low learning curve; CSMs can be productive on day one.

- Customer Support: Known for having a highly responsive and helpful internal support team.

Cons

- Data Depth: Lacks some of the “Big Data” processing capabilities of Planhat or Gainsight.

- AI Features: Less emphasis on generative and agentic AI compared to newer “AI-Native” tools.

#8 — Custify

An affordable, easy-to-implement CSP specifically designed for small-to-mid-sized B2C and B2B SaaS teams.

Key Features

- Auto-Onboarding: Triggers automated emails and in-app messages to guide new users.

- Concierge Support: The Custify team often assists with the heavy lifting of initial data mapping.

- 360-Degree View: Aggregates data from CRM, support, and billing into one clean page.

- Lifecycle Management: Clearly defines stages from trial to advocate.

- Task Automation: Automates repetitive follow-ups and account review tasks.

- Churn Prediction: Uses historical data to flag accounts that resemble previous churned users.

Pros

- Affordability: One of the most cost-effective “true” CSPs on the market.

- Simplicity: Focuses on the “essential” features without the bloat of enterprise tools.

Cons

- Advanced Customization: Not ideal for organizations with highly non-standard business models.

- Reporting: While functional, the reporting engine is less powerful than Planhat or Gainsight.

#9 — Catalyst (by Totango)

Known for its “spreadsheet-like” ease and deep Salesforce integration, Catalyst was acquired by Totango to offer a more collaborative CS experience.

Key Features

- Salesforce Bidirectional Sync: Best-in-class integration that keeps CS and Sales perfectly aligned.

- Customer Notes: Highly searchable and organized note-taking system.

- Playbooks: Automated workflows that look and feel like modern project management tools.

- Segments: Easy-to-build filters for identifying churn risk or expansion opportunities.

- Health Profiles: Allows for different health definitions for different segments (e.g., Enterprise vs. SMB).

- Community Intelligence: Built-in benchmarks to compare your team’s performance against industry standards.

Pros

- Adoption: CSMs love the tool because it feels like the modern apps they use in their personal lives.

- Visibility: Excellent for bringing “visibility” to customer data across the whole company.

Cons

- Consolidation: Since the merger with Totango, some users are wary of potential changes to the product roadmap.

- Cost: Can be expensive for smaller teams once you add all the necessary seats.

#10 — HubSpot Service Hub

While a general CRM/Service tool, HubSpot’s “Service Hub” has evolved into a viable CSP for companies already within the HubSpot ecosystem.

Key Features

- Customer Portal: Allows customers to manage their own tickets and success plans.

- Feedback Surveys: Native tools for NPS, CSAT, and CES tracking.

- Playbooks: Guided scripts and workflows for CSMs during customer calls.

- Knowledge Base: Integrated tool for creating and hosting customer-facing help articles.

- Unified CRM: No “syncing” required—customer success data lives in the same place as sales and marketing data.

- Conversation Intelligence: AI-powered recording and transcription of customer calls.

Pros

- Ecosystem Sync: If you use HubSpot for Sales and Marketing, the “All-in-One” benefit is massive.

- Ease of Use: Follows the same intuitive UX that has made HubSpot a market leader.

Cons

- CS Depth: Lacks specialized CS features like “Sponsor Tracking” or complex “Success Plan” logic found in Gainsight.

- Reporting: Cross-object reporting can still be challenging compared to dedicated platforms like Planhat.

Comparison Table (Top 10)

| Tool Name | Best For | Platform(s) Supported | Deployment | Standout Feature | Public Rating |

| Oliv AI | Agentic AI Automation | Web, Win, Mac, iOS | Cloud | Autonomous CRM Agents | 4.9 / 5 |

| Gainsight | Complex Enterprise | Web, iOS, Android | Cloud | 360 Account View | 4.4 / 5 |

| ChurnZero | Mid-Market SaaS | Web, iOS, Android | Cloud | Real-Time Alerts | 4.7 / 5 |

| Totango | Modular Scaling | Web, iOS, Android | Cloud | SuccessBLOCs | 4.5 / 5 |

| Planhat | Data Visualization | Web, Win, Mac, iOS | Cloud | Customer Portal | 4.6 / 5 |

| Vitally | Collaborative CS | Web, Win, Mac | Cloud | Shared Success Docs | 4.5 / 5 |

| ClientSuccess | Relationship Focus | Web | Cloud | Pulse Gut-Check Score | 4.4 / 5 |

| Custify | SMB / Budget | Web | Cloud | Concierge Onboarding | 4.6 / 5 |

| Catalyst | Salesforce Users | Web | Cloud | Bidirectional SFDC Sync | 4.7 / 5 |

| HubSpot Service | HubSpot Users | Web, iOS, Android | Cloud | Unified CRM Data | 4.5 / 5 |

Evaluation & Scoring of Customer Success Platforms

This scoring model reflects performance levels required to manage modern, high-growth SaaS portfolios.

| Tool Name | Core (25%) | Ease (15%) | Int. (15%) | Sec. (10%) | Perf. (10%) | Supp. (10%) | Value (15%) | Weighted Total |

| Oliv AI | 10 | 9 | 9 | 8 | 9 | 8 | 10 | 9.15 |

| Gainsight | 10 | 3 | 10 | 10 | 8 | 9 | 5 | 7.95 |

| ChurnZero | 9 | 8 | 8 | 9 | 9 | 9 | 8 | 8.55 |

| Totango | 8 | 7 | 9 | 9 | 9 | 8 | 7 | 8.05 |

| Planhat | 9 | 6 | 9 | 9 | 10 | 8 | 7 | 8.20 |

| Vitally | 8 | 8 | 8 | 8 | 9 | 9 | 8 | 8.15 |

| ClientSuccess | 7 | 10 | 7 | 8 | 8 | 10 | 8 | 8.05 |

| Custify | 7 | 9 | 7 | 8 | 8 | 9 | 10 | 8.15 |

| Catalyst | 8 | 9 | 9 | 8 | 9 | 8 | 7 | 8.25 |

| HubSpot Service | 7 | 9 | 10 | 10 | 9 | 9 | 8 | 8.55 |

Which Customer Success Platform Tool Is Right for You?

Startups & Lean Teams

For teams with fewer than 5 CSMs, Custify or ClientSuccess offer the best balance of essential features and low administrative overhead. They allow you to establish a “process” without getting bogged down in platform management.

AI-First Organizations

If your goal is to reduce headcount costs by using autonomous technology, Oliv AI is the clear leader. Its agentic approach to CRM management and forecasting is specifically built for the efficiency demands of 2026.

High-Growth Mid-Market

ChurnZero is the “Goldilocks” choice for companies with 50–500 employees. It provides the real-time visibility needed to scale quickly while remaining intuitive enough for a rapidly growing team to adopt.

Complex Global Enterprise

For organizations with thousands of employees and complex, multi-product global operations, Gainsight remains the undisputed heavyweight. Despite the high cost and complexity, its governance and reporting depth are unmatched at scale.

Frequently Asked Questions (FAQs)

What is the difference between a CRM and a CSP?

A CRM (like Salesforce) is designed for the transactional side of the business—tracking leads and opportunities. A CSP is designed for the relational and operational side—tracking usage, health, and long-term value realization post-sale.

How long does it take to implement a CSP?

It varies wildly. AI-native tools like Oliv AI can show value in 1-2 weeks. Traditional mid-market tools like ChurnZero take 4-8 weeks, while enterprise platforms like Gainsight often take 3-6 months.

Does a CSP replace my help desk (Zendesk)?

No. CSPs integrate with help desks. They pull ticket data from Zendesk to inform the health score, but the CSM usually doesn’t answer support tickets directly inside the CSP.

Is AI actually helpful in Customer Success?

Yes. AI is used to summarize hundreds of pages of call transcripts into 3 bullet points, predict which customers will churn with 90% accuracy, and automate 80% of the manual work required for QBRs.

What is a “Health Score”?

A health score is a numerical value (0-100) assigned to an account based on factors like product usage, support tickets, bill payment history, and direct sentiment feedback.

Can I use these tools for B2C?

Some tools like Planhat and Custify can handle higher volume, but most CSPs are optimized for B2B environments where individual account values justify high-touch management.

What is Net Revenue Retention (NRR)?

NRR is the metric that measures how much revenue you retain from your existing customer base after accounting for churn, downgrades, and upgrades. CSPs are the primary tool used to increase NRR.

Are customer success platforms secure?

Yes, reputable providers are SOC 2 Type II compliant and offer advanced features like SSO, MFA, and data encryption. Some also offer “Data Residency” options for EU or government clients.

Do I need a full-time admin for these tools?

For Gainsight, usually yes. For ChurnZero or Totango, a part-time “CS Ops” person is recommended. For Oliv AI or Custify, the software is designed to be self-managing.

What happens if I want to switch platforms?

Most CSPs allow for data export via CSV or API. However, the logic behind your health scores and the history of your CSM “notes” can be difficult to migrate perfectly between tools.

Conclusion

A Customer Success Platform is the heart of a revenue-focused organization. Whether you choose the legacy power of Gainsight, the AI-native efficiency of Oliv AI, or the mid-market balance of ChurnZero, the goal remains the same: driving predictable growth through customer value.